Saudi Arabia is currently undergoing a massive transformation under its Vision 2030 plan. They plan to diversify the country’s economy and reduce dependence on oil by investing in sectors such as healthcare, education, tourism, and entertainment. This presents a great opportunity for Pakistani companies to expand into the kingdom. The Saudi government has been actively inviting international companies to set up their headquarters in the kingdom and has been incentivising foreign investors. The country’s strategic location, well-developed infrastructure, and a large consumer base make it an attractive destination for businesses looking to expand their operations.

Why Saudi Arabia?

According to the Ministry of Investment (MISA), more than 70 international companies have received licenses to relocate their regional headquarters to Riyadh as part of a program to attract regional headquarters to Saudi. This is a clear indication of the Saudi government’s commitment to attracting foreign investment and promoting economic growth. With a GDP standing of USD 1 Trillion,the Saudi Arabian economy stands as the fastest-growing economies in the G20 in 2022, with growth expected to accelerate to 7% before leveling out at 3.8% and 3.0% in 2023 and 2024, respectively. Investment in the kingdom is growing93% year on year, with 44% of the entire GCC’s investment flowing into Saudi Arabia. With a well-developed infrastructure, strategic location, and a large consumer base, Saudi Arabia presents an attractive destination for businesses looking to expand their operations.

What entities can you set up when venturing into KSA?

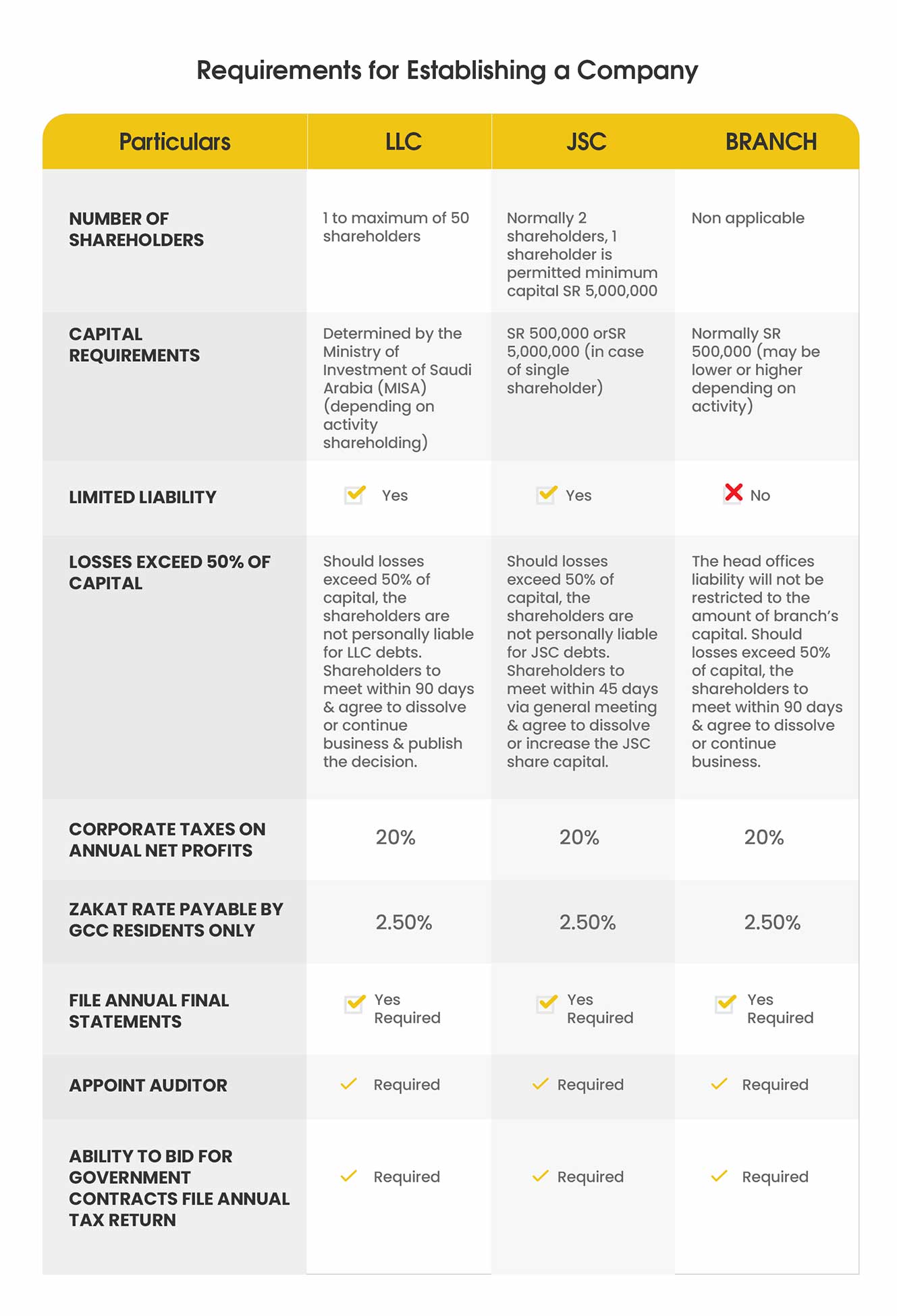

Ministry of Investment facilitates the entry of foreign enterprises to participate in various business activities. Following are the corporate structures available to the businesses looking to incorporate in KSA:

1. Limited Liability Company (LLC)

2. Limited Liability One-person Company

3. Joint Stock Company

4. Foreign Company Branch

What is Paid-up Capital?

Paid up Capital is money that a company receives by selling shares or stock directly to Investors. For a Limited Liability Company (LLC) in KSA, the Ministry of Investment of Saudi Arabia (MISA) generally requires foreign LLCs to have a minimum of SAR 500,000 share capital. This does not necessarily need to be paid down or deposited in a local bank, it can appear on the balance sheet of the business and be used as working capital. However, in certain types of activities, specific minimum capital is prescribed by MISA.

License Issuance by MISA:

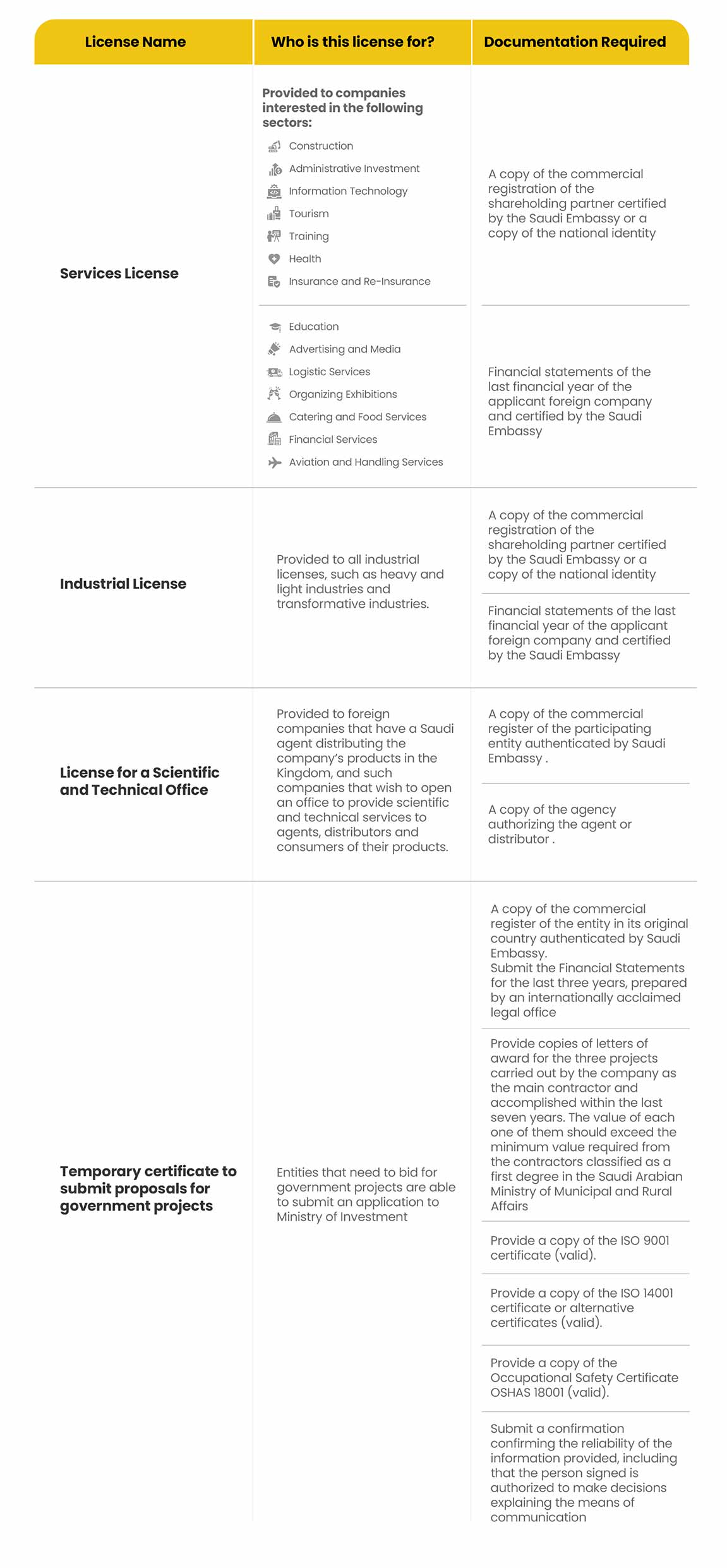

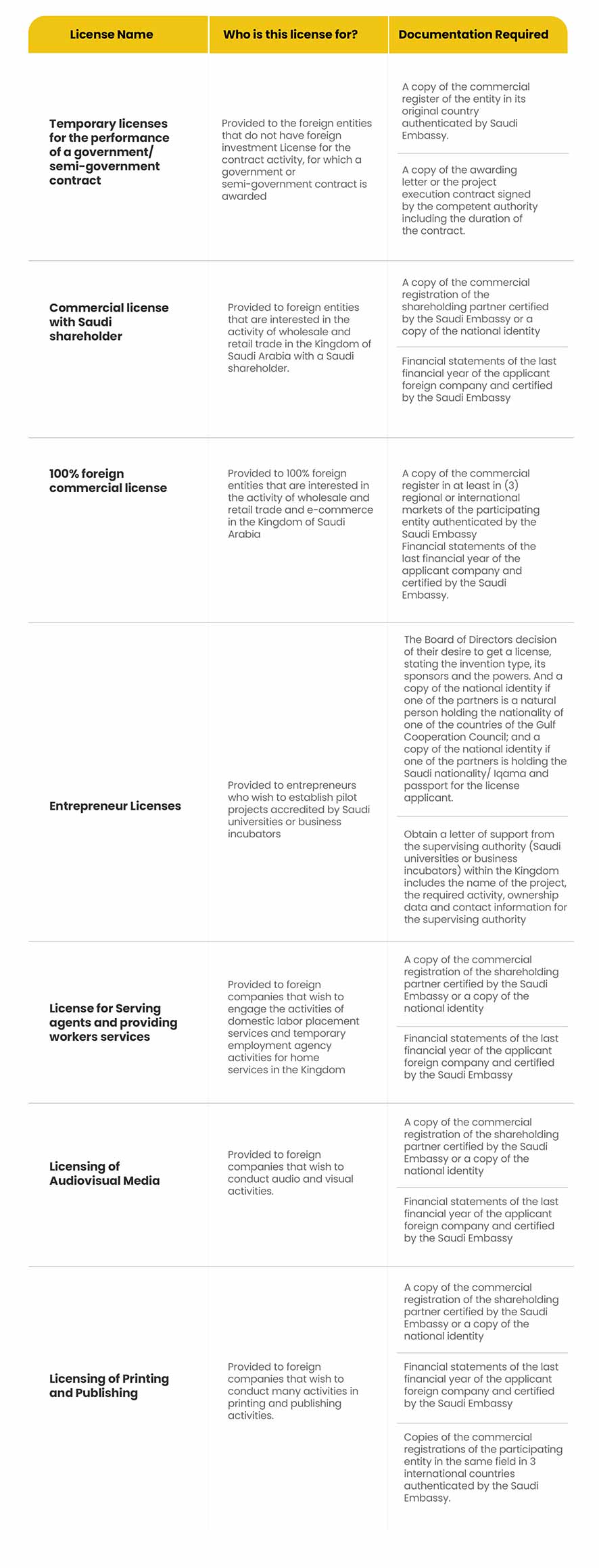

The Kingdom of Saudi Arabia grants new investment licenses and processes requests to amend existing licenses based on the principle of attracting and enabling serious investments that contribute positively to the development of the national economy and sustainable development. In order to conduct Business within the Kingdom an entity is bound to acquire a license from the Ministry of Investment (MISA).

Here is an overview of some of the key Licenses issued by the Ministry of Investment:

For most businesses venturing into KSA acquiring a Services License or an Entrepreneur License would be the way to go.

Services License:

The Services License comprises of the following activities:

- Construction

- Administrative Investment

- Information Technology

- Tourism

- Training

- Health

- Insurance and Re-Insurance

- Education

- Advertising and Media

- Logistic Services

- Organizing Exhibitions

- Catering and Food Services

- Financial Services

- Aviation and Handling Services

Documents Required for Issuance of Services License:

- A copy of the commercial registration of the shareholding partner certified by the Saudi Embassy or a copy of the national identity, if one of the partners is a natural person holding the nationality of one of the GCC countries, or a copy of the national identity if one of the partners is holding the Saudi nationality and a statement issued by “ABSHAR” System to prove the profession; or a copy of the commercial registration for Saudi companies.

- Financial statements of the last financial year of the applicant foreign company and certified by the Saudi Embassy.

Rules and Restrictions of Services License:

- Consistency between the total percentage of the Saudi (shareholder/ shareholders) and the capital according to the financial limits set forth for the type of activity as outlined by MISA

- Premium residence holders are exempted from the above documents.

- In case that one of the partners was previously licensed by Ministry of Investment, it must be clarified when filling in the partners’ data while submitting the electronic application.

- In case the licensed business related to construction, the company should not practice any activity related to provision of consultations of any kind.

- In case the license is a health activity, the following shall be required:

- The legal entity must be a company.

- The health facility must have accreditation from a recognized health organization.

- Have at least three years of experience in the country of the establishment.

Service Fees:

- Payment of license fee of two thousand (2000) Saudi Riyals annual for 5 years as maximum.

- Payment of ten thousand (10,000) Riyals as subscription for the first year to obtain services from Ministry of Investment investors’ relations centers. Afterward, the fees is applied as subscription fees for services in the following years (SR 60,000).

Service fees shall be paid within 60 days from the date of bill issuance. In case of the payment’s delay within the identified period, the service will be cancelled and the applicant will have to apply again.

Entrepreneur License:

License is provided to entrepreneurs who wish to establish pilot projects accredited by Saudi universities or business incubators .

Documents Required for Issuance of Entrepreneur License:

- The Board of Directors decision of their desire to get a license, stating the invention type, its sponsors and the powers. And a copy of the national identity if one of the partners is a natural person holding the nationality of one of the countries of the Gulf Cooperation Council; and a copy of the national identity if one of the partners is holding the Saudi nationality/ Iqama and passport for the license applicant.

- Obtain a letter of support from the supervising authority (Saudi universities or business incubators) within the Kingdom includes the name of the project, the required activity, ownership data and contact information for the supervising authority

Rules and Restrictions of Entrepreneur License:

- In case that one of the partners was previously licensed by Ministry of Investment, it must be clarified when filling in the partners’ data while submitting the electronic application.

- Authorized Saudi universities or business incubators shall approve the license applications.

- If the applicant is a resident of the Kingdom, the Saudi sponsor should submit a letter of no objection.

- The duration of the license is one year and is renewed annually for the first five years with the approval of the supervising authority

Service Fees:

- Payment of license fee of two thousand (2000) Saudi Riyals annual for 5 years as maximum.

- Payment for obtaining services from Ministry of Investment investors’ relations centers according to the entity’s classification rather than entrepreneur license at the end of the 5th year.

Service fees shall be paid within 60 days from the date of bill issuance. In case of the payment’s delay within the identified period, the service will be cancelled and the applicant will have to apply again.

1. LIMITED LIABILITY COMPANY (LLC)

An LLC is a one of the most common legal entities preferred by foreign investors to set up a company in Saudi company. A minimum of one shareholder and not more than fifty shareholders is required for the business registration process. If the shareholder count exceeds fifty, the LLC must be converted to a Joint Stock Company within a year. Shareholders may be natural persons, corporate entities, or a combination to form an LLC. This corporate vehicle is favored by foreign investors looking to enter joint ventures with individual Saudi nationals or Saudi companies.

WHAT CAN A SAUDI LIMITED LIABILITY COMPANY DO?

A limited liability company can engage in the business activities which are described under the approved Commercial Registration, participate in public or private sector contracts, sponsor foreign employees for residency, obtain a corporate bank account and invoice customers and pay suppliers etc.

WHAT ARE THE OWNERSHIP & CAPITAL REQUIREMENTS FOR A SAUDI COMPANY?

The LLC is not required to have a board of directors. However, many companies decide to establish a board and integrate this requirement into their Memorandum and Articles of Association.

There is no limitation on the percentage of foreign ownership for an LLC. Personal liability of each shareholder or partner is limited to the individual shareholders contribution to the share capital. Since there is no legislative minimum capital requirement. Paid-up capital amounts will vary depending on the business activity and ownership structure. The Ministry of Investment of Saudi Arabia (MISA) formerly known as Saudi Arabia General Investment Authority (SAGIA) will determine the amount of capital upon application.

HOW TO SETUP A SAUDI LIMITED LIABILITY COMPANY?

Incorporating an LLC is initiated at the Ministry of Investment of Saudi Arabia. Once all the company legal documents are finalized, the Commercial Registration (CR) certificate is issued. At this point the LLC is required to fully complete all government registrations and external approvals in Saudi Arabia. Post company incorporation involves several government files and registrations, and this can take several weeks or months to completed enabling the LLC to be fully operational.

The main Saudi government registrations include:

- Ministry of Human Resources and Social Development (HRSD)

- General Organization of Social Insurance (GOSI)

- Zakat, Tax and Customs Authority (ZATCA)

- National Address (SPL)

Note the above is not a complete list of Saudi government registration requirements. Saudi business and investment regulations are continuously changing. We recommend foreign businesses to engage with Creation Business Consultants to complete the entire process guaranteeing your business will comply with up-to-date regulations.

WHAT PRACTICES SHOULD BE CONSIDERED FOR OPERATING A SAUDI LLC?

It is recommended to: Seek tax and corporate structuring advice from our consultants to ensure the LLC structure is correct for your business model and group structure;Engage with Creation Business Consultants to guide you on the correct compliance processes for invoicing, accounting, bookkeeping, tax registration and reporting as per Zakat, Tax and Customs Authority (ZATCA) ; and Appoint an auditor post company formation.

2. BRANCH OF A FOREIGN COMPANY

A foreign company can setup and operate a foreign owned Saudi branch office. This entity type is also preferred by foreign companies to enter the Saudi market.

WHAT CAN A SAUDI BRANCH DO?

Upon registration the branch business activities must match the parent company. Post setup the Saudi branch can only engage in commercial activities within the license’s scope, participate in public or private sector contracts, sponsor foreign employees for residency, obtain a corporate bank account, invoice customers and pay suppliers etc.

WHAT ARE THE CAPITAL REQUIREMENTS FOR A SAUDI BRANCH?

The company must deposit an amount equivalent to the capital required for a subsidiary, which comes down to a minimum of SAR 500,000. It is mandatory to complete the paid-up capital requirement and deposit this to a local Saudi bank. The parent company adopts full liability for the business activities the Saudi branch participates in.

HOW TO SETUP A SAUDI BRANCH?

To form a Saudi branch office, you must have an existing company in another country. The Saudi branch office is 100% owned by the foreign investor (parent company).

Incorporating a Saudi branch is initiated with the Ministry of Investment of Saudi Arabia (MISA). The Ministry of Commerce and Industry issues the Commercial Registration for the branch. The branch setup may be quicker than an LLC or JSC since there are no reserve requirements or Articles of Association to be approved.

It is recommended to seek tax and corporate structuring advice from our consultants to ensure forming a Saudi branch office is the correct course for your company group structure. An auditor must be appointed once the branch setup is finalized.

3. JOINT STOCK COMPANY (JSC)

Saudi joint stock is the equivalent of a publicly listed company. Closed JSC are unlisted, public JSC is listed on the Saudi Stock Exchange and are subject to a much higher degree of oversight. This company setup structure is popular with multinational companies or companies that are already publicly listed on other stock exchange markets. The company laws in Saudi states if the number of shareholders exceeds more than fifty in a limited liability company must be converted to a joint stock company within a year. Further regulations imposed on JSCs increase compliance costs considerably as compared with LLCs.

WHAT CAN A SAUDI JOINT STOCK COMPANY DO?

The JSC can engage in the business activities which are described under the approved Commercial Registration, participate in public or private sector contracts, sponsor foreign employees for residency, obtain a corporate bank account, invoice customers, pay suppliers, and disburse dividends etc.

WHAT IS THE OWNERSHIP & CAPITAL REQUIREMENTS FOR A SAUDI JOINT STOCK COMPANY?

For a Saudi joint stock company setup, a minimum of two shareholders are required. There is no maximum number of shareholders. At least three directors (can be non-Saudi residents) must be appointed for the company incorporation. Shareholders may be natural persons, corporate entities, or a combination to form a Saudi joint stock company. The shareholder register must be lodged with the Ministry of Commerce (MOC) and updated as required.

The minimum share capital requirement to incorporate a JSC in Saudi Arabia is SAR 500,000. The Ministry of Commerce and Industry may approve for the capital to be paid in stages. The capital of this entity is divided into negotiable shares of equal value and are typically provided via share certificates. A joint stock company is liable for debts and liabilities arising from its activities.

HOW TO SETUP A SAUDI JOINT STOCK COMPANY?

Incorporating a Saudi joint stock company is initiated at the Ministry of Investment of Saudi Arabia (MISA). Once all the company legal documents are finalized, the Commercial Registration certificate is issued.

Like the LLC set up, the post incorporation involves several government files and registrations, and this can take several weeks or months to be completed to enable the JSC to be fully operational.

The main Saudi government registrations include:

- Ministry of Labor and Social Development (MLSD)

- General Organization of Social Insurance (GOSI)

- Zakat, Tax and Customs Authority (ZATCA)

- Local business address (Wasel)

Note this is not a complete list of Saudi government registration requirements. Saudi business and investment regulations are continuously changing. We recommend foreign businesses engage with Creation Business Consultants to complete the entire process guaranteeing your business will comply with up-to-date regulations.

It is recommended to seek tax and corporate structuring advice from our consultants to ensure the JSC structure is correct for your business model and group structure. An auditor must be appointed once the company formation is completed.

WHAT CAN A SAUDI ESTABLISHMENT COMPANY DO?

This company can engage in the business activities which are described under the approved Commercial Registration, participate in public or private sector contracts, sponsor foreign employees for residency, obtain a corporate bank account and invoice customers and pay suppliers etc.

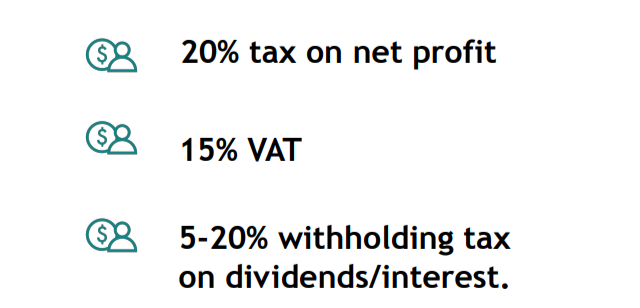

Taxation in Saudi Arabia:

Like most other states in the GCC, Saudi Arabia levies corporate income tax on the non-resident’s share in a resident corporation; the share of Saudi and GCC nationals is subject only to a religious levy called Zakat, which is levied on net equity. If a company is a joint venture between a Saudi/GCC shareholder and a foreign shareholder, the portion of taxable income attributable to the foreign shareholder is subject to income tax and the Saudi shareholder’s share of net equity is subject to Zakat.

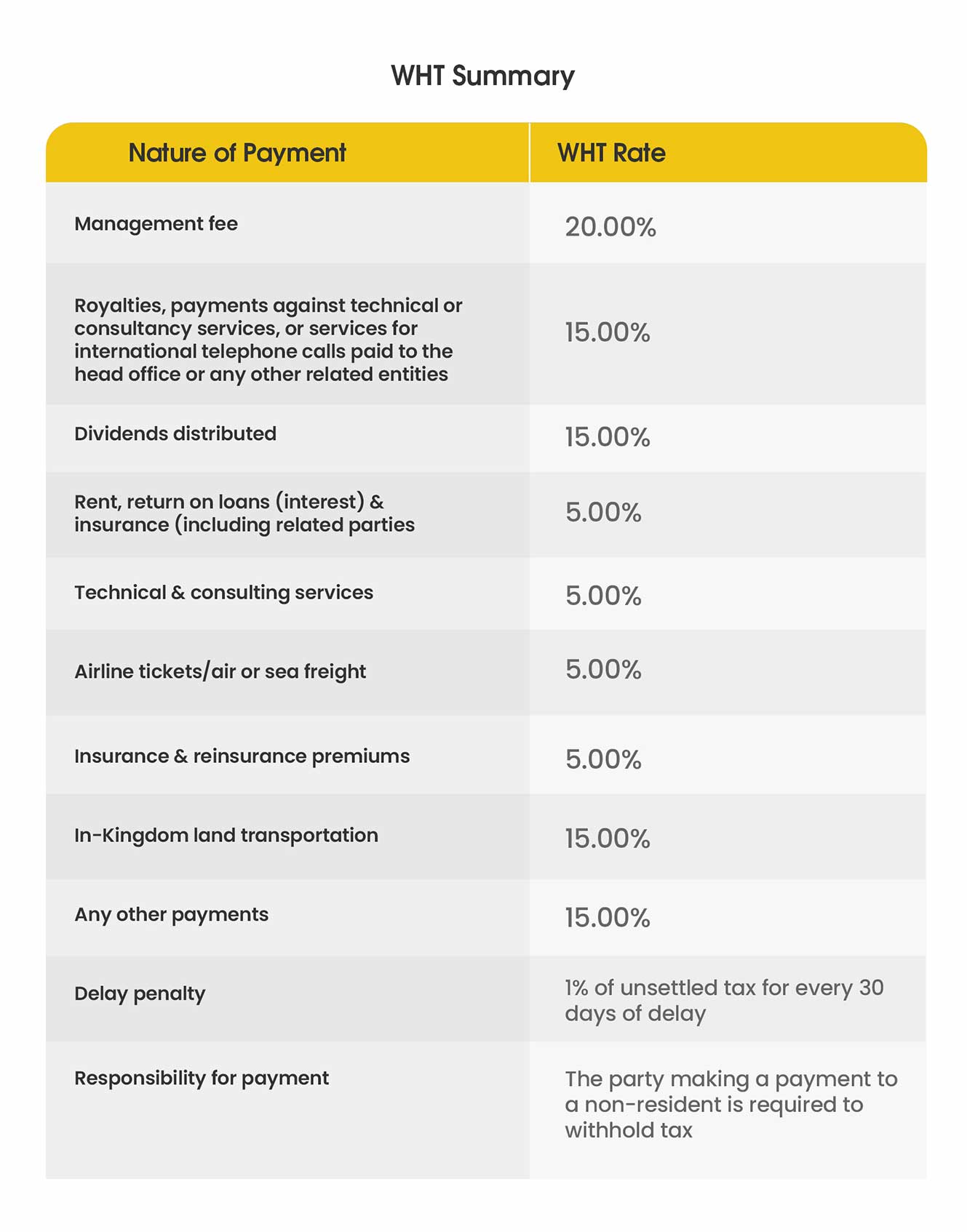

The general tax burden of a Saudi entity owned by foreign companies. The share of taxable profit owned by the non-Saudi/non-GCC shareholder will be subject to 20% corporate income tax on net profit, VAT of 15 %, in addition to 5% withholding tax (WHT) applicable on the distribution of dividends to the non-resident (including non-resident GCC) shareholders. However, the Saudi/ GCC shareholder will be subject to Zakat. For financial years commencing on or after 1 January 2019, Zakat is assessed at 2.5% on the higher of the Zakat base (balance sheet basis) and the net adjusted profit of Zakat payers following the Hijri year. For Zakat payers following the Gregorian year, the rate applicable to the Zakat base is 2.577683% (balance sheet basis). A simple calculation of the balance sheet basis includes the Saudi shareholder’s share of equity plus long-term liabilities less fixed assets. As per the domestic regulations, the accounting treatment for Zakat and income tax in joint venture companies is charged to the company’s income statement.

Annual Recurring Fees:

Overwhelmed with all this information?

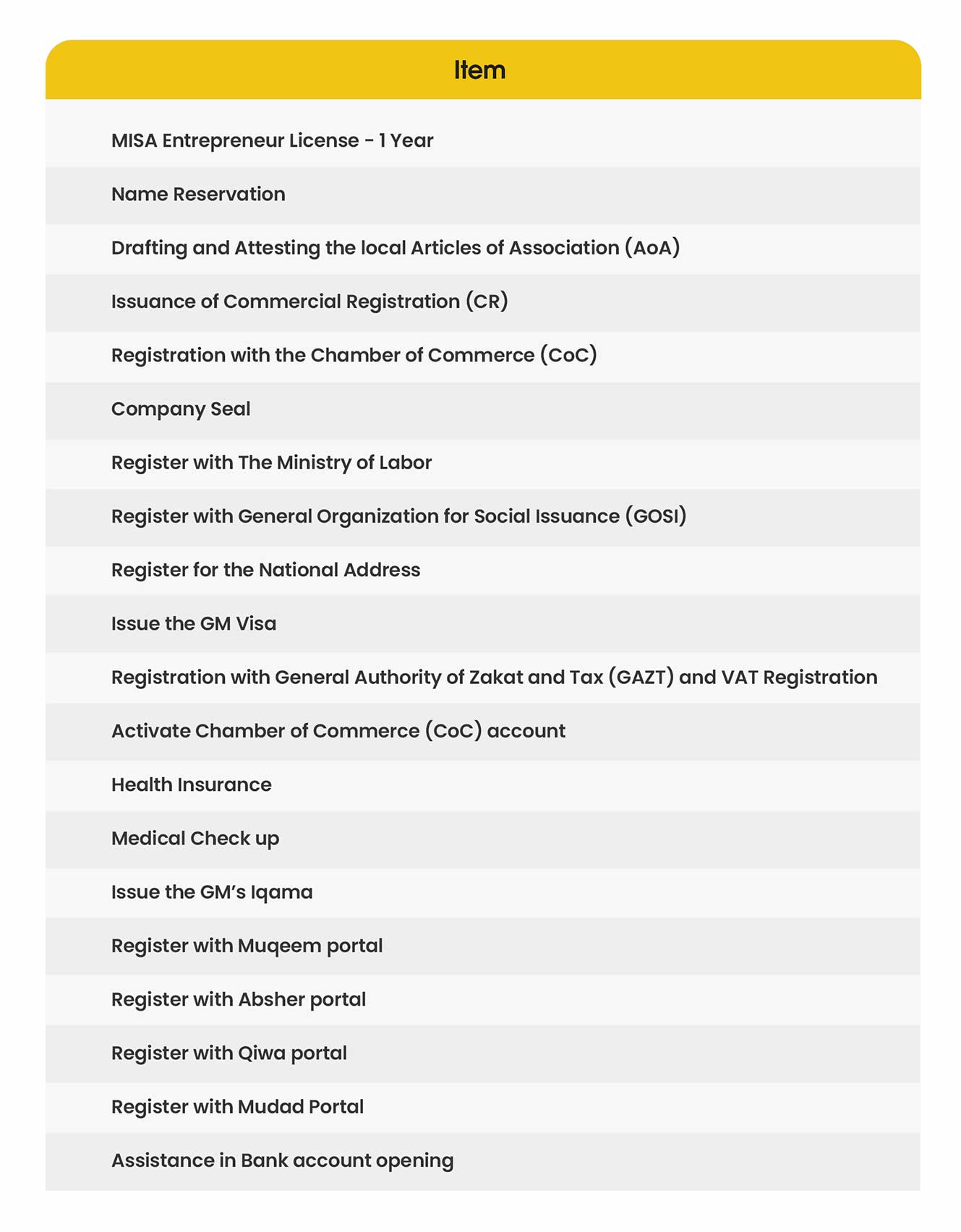

If all of this information was too much to absorb we have created a twenty point checklist with the help of Astrolabs.

If you want an all in one hassle-free smooth transition to the Kingdom, it is best to get a Strategic Partner like Astrolabs on board.

AstroLabs is positioned as the number one expansion partner in KSA with a fully integrated offering for all companies looking to operate in the Kingdom. AstroLabs has helped 450+ businesses scale to the Kingdom from setting up, soft landing, to multi-platform registration and their first local hire. Beyond setup, AstroLabs is the Kingdom’s default expansion partner, enabling high-growth businesses to scale through value-based talent recruitment, team structure & building, and support network access programs.

AstroLabs has built a reputation for demystifying the process of setting up a business in Saudi Arabia. With their deep-rooted understanding of the local market and close ties with regulatory bodies, they offer a seamless and efficient company setup process. Their team ensures that you’re not just compliant with local norms, but also poised to leverage the Kingdom’s vast potential to its fullest. From obtaining the required licenses to understanding local customs and business etiquettes, AstroLabs offers a holistic support system. Their in-house experts provide insights into the Saudi Arabian market, ensuring that your business aligns with the cultural and commercial fabric of the nation. By setting up your business through them, you gain access to a thriving ecosystem of startups, investors, and industry professionals. Regular networking events, workshops, and seminars become platforms for you to foster collaborations, find potential clients, and establish a strong foothold in the market.

Kickstart aims to catalyze this process and hopes for maximal Pakistani presence in the Saudi Market. Having hosted over 1200 companies ever since our inception, Kickstart believes that it has a good understanding of the resilience of Pakistani Companies and the output they can generate. Kickstart believes that Pakistani companies can thrive in the emerging Saudi economy. Kickstart aims to play its role in establishing a Pakistani footprint in the Saudi Market. In our efforts in doing so we have partnered up with Arstolabs to give you exclusive discounted deals on all of their plans, if you sign up with us. In order to get access to those discounts and Kickstart your journey to the KSA, fill out this form.