By Saad Riaz (Co-founder – Kickstart Coworking Space)

In 2016, a few months after I graduated from college, I was sharing a place with one of my friends. Before moving to that place, my friend (now co-founder) was looking for a decent small space only for himself. However, after a failed search for a decent upper portion, my friend rented an entire house and sublet it to his friends (including me).

During the same time, he was also looking for a small office to house his ed-tech venture’s 5-person team.

Low on budget and high on passion, he searched through Zameen.com, engaged property brokers & later did space visits in DHA & Gulberg too – complete office floors in DHA were too expensive; Gulberg spaces were good on budget but did not have the experience he wanted to give to his team.

After a couple of weeks of searching, he was far from finding a suitable office space.

Meanwhile, our living arrangement at that time was working great. We could share a housekeeper, utilities, internet, and divide household chores.

In the backdrop of his experience of renting an entire house, subletting it, and sharing costs and management, my friend had no hesitation applying his learning to rent an office space.

In the coming weeks, we set up a small space for 30-35 people with very basic furnishing. We called it a “shared office.” We learned a month later that it was generally called a “coworking space” in other parts of the world.

In the early days, we received high interest only from small teams and freelancers. However, we started receiving interest from SMEs and more prominent companies when we established a bigger and better facility at Gulberg a year later. It was at that time when we began to learn the magnitude and complexity of real-estate problems facing SMEs and corporations.

During our interaction with SMEs, Startups, and building (office real-estate) owners in the following period, we saw a massive gap between the needs of modern workers and supply in the Office Real-Estate (ORE) market.

The gap wasn’t about the number of square feet available. There was (and still is) tens of thousands of square feet of vacant office supply available, but the supply isn’t attuned to the demands of potential tenants.

SMEs mainly drive the ORE demand in Lahore compared to Karachi and Islamabad, where the financial sector, large corporations, and development sectors dominate office demand.

According to a 2012-13 colliers international report (just before the introduction of 3G), there was a high demand for offices of size 800- 1500 sq.ft. in Lahore. However, there was a lack of demand for Grade-A properties and large floor plates (usually required by the corporate sector). Introduction of 3g and 4G, coupled with overall high internet penetration and IT literacy, has brought a boom for small-scale IT companies and freelancers in Lahore. As a result, the already huge contribution of SMEs in the office market has risen even more.

IT or non-IT – these companies majorly employ millennial workers with an average age in the late twenties and early thirties. For a demographic perspective on the labor market, consider the fact that 40% of Pakistan’s 200+ million population lies in the age bracket of 15-40 with another 36% below the age of 15.

-Millennial workers want to work from cool workspaces hosting a dynamic community (Image: Kickstart Gulberg 58-A2)

In Kickstart’s interaction with more than 25+ such companies during the last two years, we have learned that they have a few common pain points.

Tenant Pain Points

Flexibility

These SMEs find it hard to scale up or down after entering into a long-term rental contract and setting up an office. There is no surety whether they would find space adjacent to their existing office if they decide to scale up in the future. Scaling down on office space isn’t very convenient either. What if the company has to ramp up again soon? They will have to bear the upfront costs again in this case, so most of the companies keep lingering on the decision while incurring the costs of vacant space.

Cost and Hassle of Setting Up & Managing an Office

There is a high managerial cost of dealing with informal vendors in Pakistan. The furnishing task requires hundreds of small decisions, which is not a competency of most businesses. Moreover, the job requires a significant investment in fixed assets – most of which are not movable. Then there is the difficult task of procurement related to furnishing.

Managing an office is another challenge. Smaller enterprises suffer with management since the task of office administration is taken up as a secondary task by founders or team leads. Medium and large companies have to raise dedicated functions and incur high costs to manage office operations.

Attracting and Retaining Quality Talent

Attracting and retaining quality talent is a challenge faced by almost all companies. It just intensifies further for SMEs and startups with scrappy cash flows and secluded offices. Nearly all SMEs we have hosted at Kickstart faced this challenge. Physical workspace – after the coworkers and managers – is one of the most critical touch-points between an employee and his company. Millennial and Generation Z employees love flexibility and diversity in office design: they want an aesthetically designed workspace with different areas for work, meetings, relaxing and dining, and even workout.

-Fitness studio at Kickstart’s Latest Location

A workspace that provides them their desired office experience while also offering a dynamic community of people outside their office drastically increases the company’s chances of retaining its resources.

Keeping in view the pain points of the office tenants, now let’s have a look at the supply side of the market.

(Below insights come from our interaction with landlords and seasoned brokers & developers in Lahore. There is a dearth of research and credible data on the office real-estate market.)

Small Landlord

Most of the ORE supply is formed by small landlords who invest in property, keeping in view the “safety” of investment. A small investor usually makes up his mind on the advice of close friends and acquaintances who are “into property” and makes the final decision under the influence of hype created by real-estate brokers.

Professional Real-estate Developers

They form a small part of the total ORE supply where investors invest in properties developed by professional property developers.

Professional developers have a better understanding of the building layout and design suitable for tenants of unfurnished office properties. However, they don’t take into account the “office experience” expected by the millennial workers in today’s organizations.

After selling large ORE projects in parts to small landlords and real estate investors, building developers have no incentive to manage the building experience. As a result

- Management of common areas of building suffers

- Building experience gradually degrades

- Resulting in low-quality tenant experience, vacant floors, and low yield for property owners (investors)

This has been the story of much of the ORE projects of the last decade in Lahore. There are a few exceptions where forward-looking developers appoint professional building management staff to maintain building experience for the longer-run.

– “The Enterprise” – A well-managed office building near Thokar Niaz Beg, Lahore. (Source: http://theenterprise.pk/)

Lack of Research around Evolving Tenant Needs

Apart from a few professional ORE developers, most landlords take their decisions to buy land and build on it based on the amateur opinion of their acquaintances and close friends. They do very little research on what their customer needs are. From building design to rental model and branding to common area management (CAM), there is a lack of research into evolving customer requirements.

ORE Owners as “Rent-Collectors”

The priority of ORE owners is to earn maximum rental yield while facing the least hassle. They neither prefer to customize any aspect of the building based on what their customer wants, nor do they want to provide any service. They abhor short-term tenancy since changing tenants frequently results in a significant amount of hassle and financial loss. They are, therefore, in favor of long-term contracts – hence the famous desire for stable “Bank or Multi-national” tenants.

Shift From “Rent Collectors” to “Service Providers”

Rising internet penetration in Pakistan, coupled with a large IT talent base, has given rise to the gig economy and a new class of agile technology SMEs.

According to the state bank data, Pakistan’s IT exports have tripled between FY’13 to FY’19.

These agile SMEs need answers to questions like how they would manage if they have to scale their team from 50 to 100 people rapidly. Will they pack up and shift to a bigger space? Changing offices is a tiresome experience and results in substantial productivity & financial losses. Maneuvering becomes complicated once a high investment is made in fixtures and furnishing assets. So these companies prefer an asset-light model.

This new group of companies has provided vital early adopters for the flexible and managed office sector.

In FY’18, Kickstart’s 80% member base came from the tech sector. However, the percentage decreased in FY’19 when some companies from other sectors also joined in.

Moreover, the entry of unicorns like Careem, Uber, Alibaba (Daraz), and KeepTruckin has trained local talent. This pool is now starting its own companies or joining other startups and SMEs. Moreover, Pakistani diaspora working in big companies is coming back to Pakistan to set up their SME and startup teams. This new breed of trained talent has exposure to progressive culture and the value system of these companies. Priorities like employee well-being and engagement – which are better served by flexible and managed offices – are high up on their priority list.

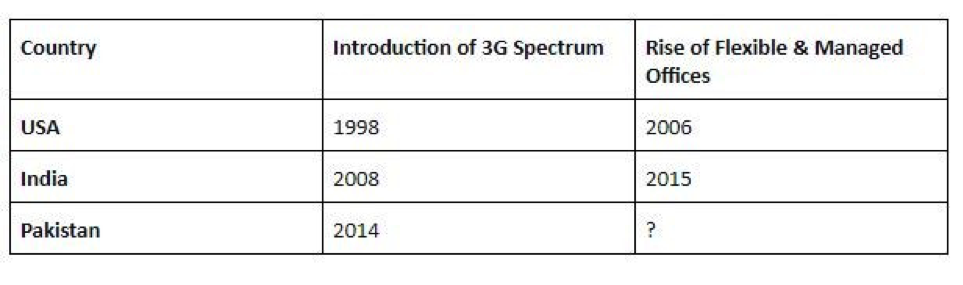

Across the world, the adoption of flexible and managed offices is directly linked with internet penetration and the rise of the gig economy.

The evolving tenant demand for flexible contracts, low upfront costs, and fully managed offices have driven the shift to flexible and managed offices in all developed economies, and emerging economies are now catching up. Coworking and flexible space operators leased more than one-third of the total office space in the US last year. In Indian tier 1 cities, coworking and flexible space operators have leased up to 22% of the entire office space entering the market.

Pakistan is not far behind, and the segment picked up fast in 2019. Much work still needs to be done here for the wide-spread adoption of the ORE Model. However, the platform is set, and 2020 will prove to be a game-changing year for this decades-old ORE industry.

The above thoughts come from my three years of experience at Kickstart. During this time, we furnished 32000+ square feet of office space and served 2500+ members.